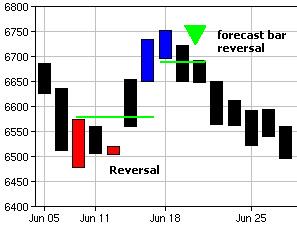

The forecasts can mean buying or selling pressure has built up so much a new high or low price will happen soon forming a continuation of the trend OR the price is overdone, and a close of a bar moving in the opposite direction to the last forecast bar could signal a trend failure or reversal point.

For instance if there has been 2 up forecast bars in a row but the price is failing to break onto a new high, then also watch for a reversal in the price to break below the last "signal bar" low price. Vice versa for upward reversals.

In strong trends these forecasts are usually continuation signals, in ranging markets they are reversal points.

Our Extreme Theory Example :-

Setup bar at the extreme low of the given day, the subsequent bar is the signal bar for entry stop plus stop loss. after 40 points of reward, a contra/exit setup bar at extreme high of the given day, the subsequent bar is signal for exit the position.

0 Comments:

Post a Comment